Those who’ve taken notes from the past two years of market disruptions know this: steady and nimble wins the race. To stay relevant and be prepared for what’s next, knowing what people are prioritising and what drives their interests is key, and for this, no guesswork is necessary.

We analysed Search data in Indonesia across three major industries — retail, technology, and finance, to find out what’s top of mind among consumers for these sectors, and discovered two key insights from the Search trends. One, people are looking for instant gratification more than ever, and two, they are increasingly embracing a seamless online-offline lifestyle.

What do these Search insights mean for your brand? We show you how the latest consumer behaviour trends in Indonesia can inform your marketing strategies to meet customers’ needs and fuel business growth.

People are choosing to act now, not later

Empowered by Indonesia’s rapid digitalization, consumers across retail, technology, and finance are looking for ways to act instantly on their needs and wants. This includes supporting sustainable technology with a low carbon footprint and using buy now, pay later financing options.

Retail

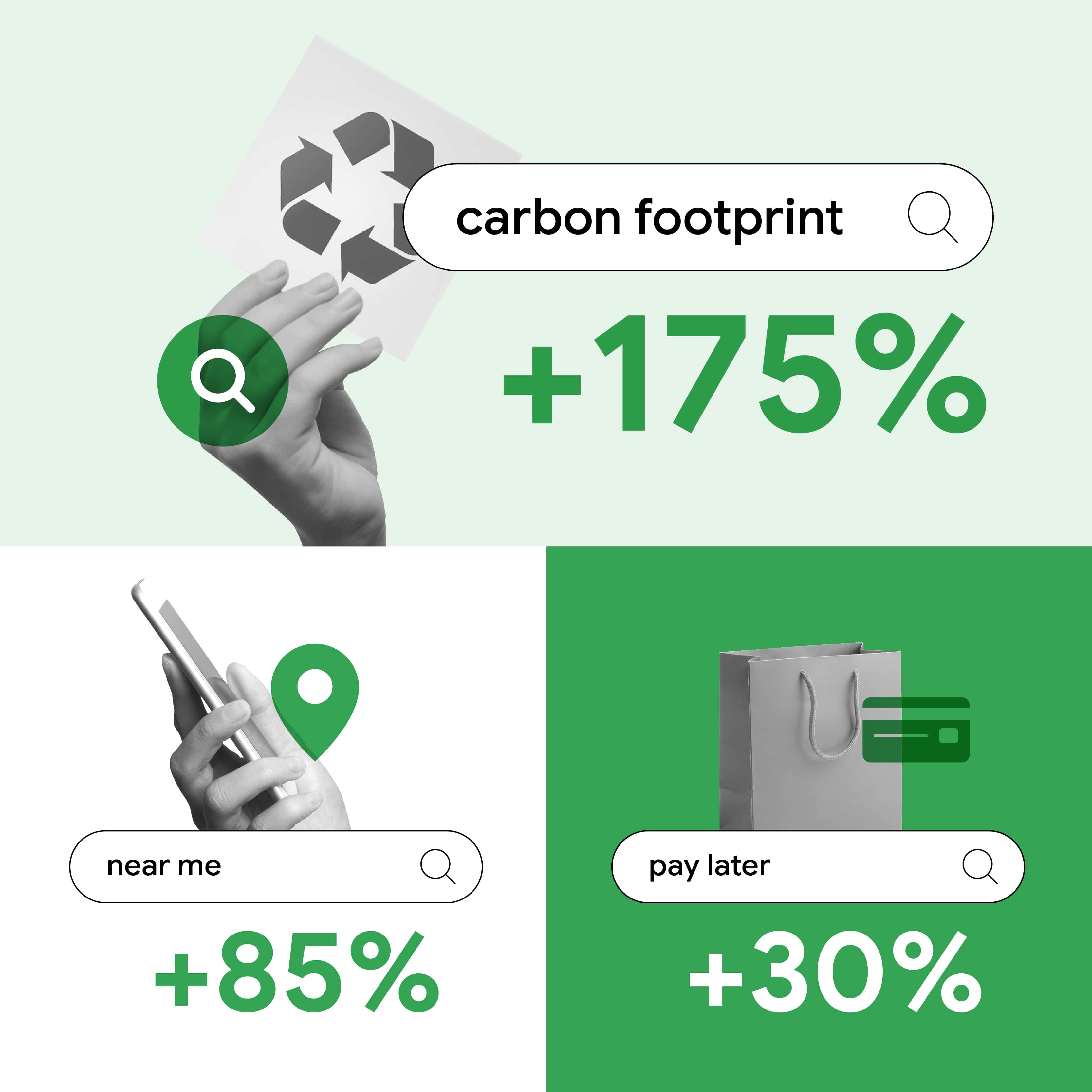

The convenience of online shopping remains a priority for shoppers, as seen in Indonesia’s booming e-commerce scene. Search interest in “same-day delivery” and “free delivery” grew over 35% and 15%, respectively, in the last two years, especially during peak shopping moments such as Ramadan.1 However, as pandemic restrictions ease and in-person activities resume, consumers are now seeking to have products in their hands immediately, with search interest in shops “near me” growing over 85%.2

Technology

Sustainability has become an increasingly important topic among consumers, with search interest in “sustainability” rising over 50%.3 Consumers are also holding brands accountable for their environmental impact, following Indonesia’s commitment to support green activities in the region. Search interest in “carbon footprint” grew over 175% in the last year.4

Finance

As consumers face rising costs of living and inflation, they’re looking to ease their financial concerns and better manage finances through means such as short-term financing and tax amnesty, on the back of changing taxation laws. Search interest in “pay later” grew over 30% in the last year,5 and search interest in “tax amnesty” grew over 4X.6

People are also careful about their investments in the current economic climate and are seeking out instant access to the latest financial information to help them make savvy decisions. For instance, search interest in “fear and greed index” grew over 9X.7

What this means for your brand

To meet consumers’ demand in real-time as they search and act with urgency, automated marketing solutions can help. Broad match, for example, enables your ads to automatically reach people whose searches are related to your keyword, even if their searches don’t contain the exact same words. This means you’re able to reach more potential customers, and on a scale that cannot be matched by manually entering hundreds of separate keywords.

Keeping your finger on the pulse of consumer interests in products and services related to your business can also help you respond quickly to changing consumer behaviour trends and capture new demand. The Insights page surfaces such information specific to your brand, and identifies opportunities to improve your campaign and grow your business.

People are embracing a seamless online-offline lifestyle

As people move between the online and offline worlds, they’re looking for ways to transcend the divide effortlessly, such as through virtual shopping experiences, cross-platform online entertainment, and digital payment solutions.

Retail

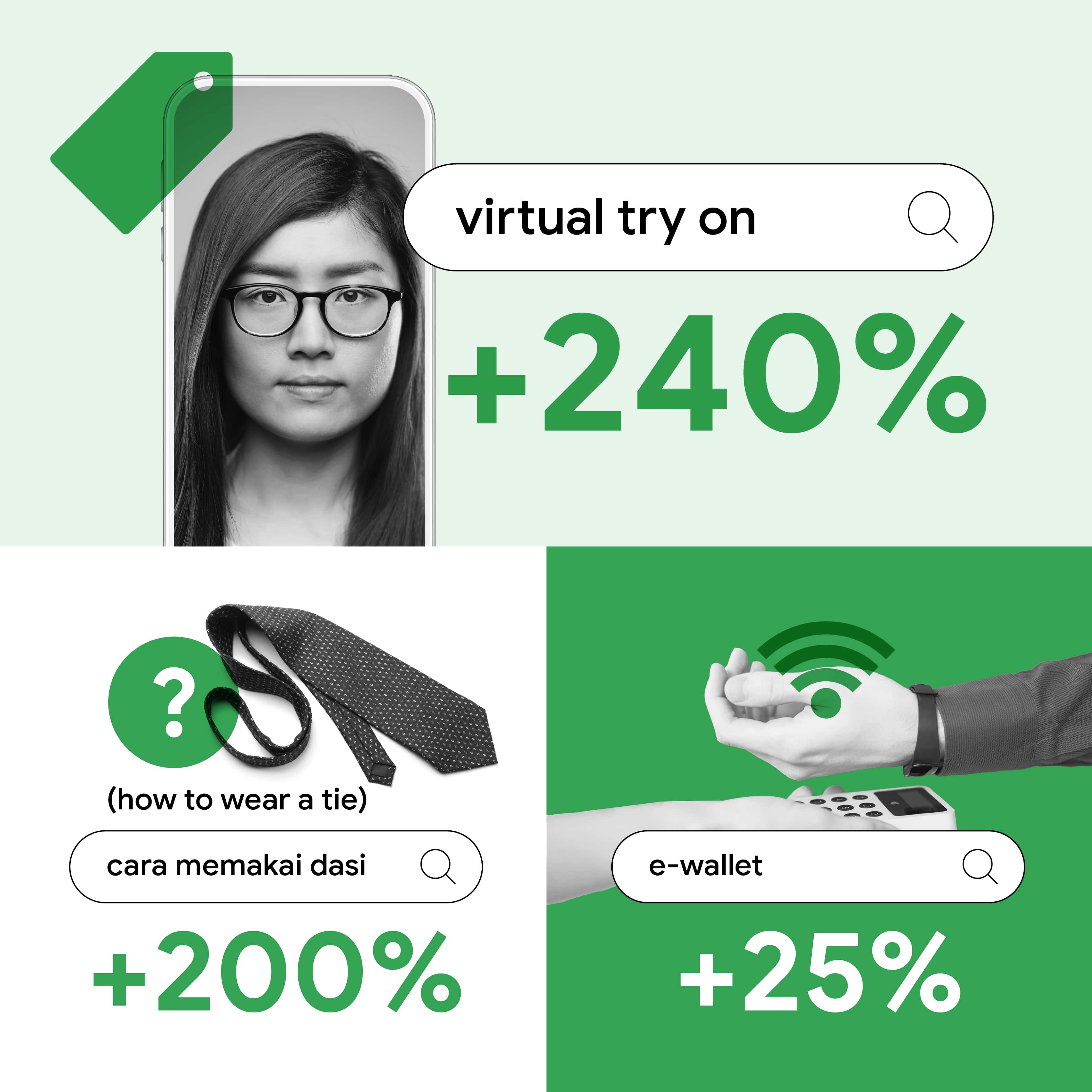

With the easing of pandemic restrictions on in-person activities, shoppers are searching for ways to resume life offline and navigate the new online-offline way of life seamlessly. The return to school, work, and in-person events, for example, have fueled an increase in fashion-related searches. Search interest in “cara memakai dasi” (how to wear a tie) grew over 200%, and search interest in “wedding heels” grew over 5X.8

Online shopping experiences that enable people to try on clothing virtually before buying it and wearing it out in person are also gaining traction. Search interest in “virtual try on” grew over 2.4X.9

Technology

People are also moving between the online and offline worlds through entertainment. They’re looking for ways to watch content seamlessly across devices, platforms, and channels, and this is mirrored in search interest in “tv digital” which has grown over 2.7X.10

Finance

Another way people are embracing a seamless online-offline lifestyle: using digital payment solutions that enable them to shop and pay whether online or in stores. Search interest in “e-wallet” grew over 25% in the last year.11

What this means for your brand

As people in Indonesia embrace a seamless online-offline lifestyle, brands that want to understand consumers and connect directly with them in meaningful ways should have an omnichannel presence.

An agile omnichannel strategy enables you to integrate online and offline channels, making it easy for people to access your brand at any point in their consumer journey, whether online or offline. To further merge the online and offline realms, immersive technologies like augmented reality, virtual reality, and 3D simulation can help you create engaging experiences that draw people back.

Another way to bridge the online-offline divide is to build customer loyalty through app engagement. Research shows that 93% of APAC app users who use a brand’s app frequently are likely to have a greater affinity for the brand as a whole.12

It’s anyone’s guess as to which direction markets will head in the coming months, but with Search data, automated marketing solutions, and app and omnichannel strategies, brands can anticipate consumer behaviour trends in Indonesia and respond to customer demand whenever and wherever.

Contributors: Jasmine Li, Product Marketing Manager, APAC Search Ads; Andre Sostar, Analyst, APAC Consumer and Market Insights